Quantifying Political Risk for

High Growth Companies

Quantifying Political Risk for

High Growth Companies

Quantifying Political Risk for High Growth Companies

Rivendell Strategies helps venture-backed startups and emerging tech companies protect enterprise value through proactive political intelligence.

Rivendell Strategies helps venture-backed startups and emerging tech companies protect enterprise value through proactive political intelligence.

Rivendell Strategies helps venture-backed startups and emerging tech companies protect enterprise value through proactive political intelligence.

$3B+ In Portfolio Value Protected

$3B+ In Portfolio Value Protected

Political risk is now a material driver of valuation, diligence, and exit outcomes

32% of venture-backed companies

face regulatory or political crises that materially impact valuation

89% of Series C+ investors

now require formal political-risk assessment during due diligence

Unmanaged political risk leads to capital erosion,

including 30–50% valuation discounts and $2M–$50M crisis response costs

Failure to anticipate risk delays or destroys exits,

causing 12–24 month fundraising delays, fire-sale exits, or shutdowns

Political risk is now a material driver of valuation, diligence, and exit outcomes

32% of venture-backed companies

face regulatory or political crises that materially impact valuation

89% of Series C+ investors

now require formal political-risk assessment during due diligence

Unmanaged political risk leads to capital erosion,

including 30–50% valuation discounts and $2M–$50M crisis response costs

Failure to anticipate risk delays or destroys exits,

causing 12–24 month fundraising delays, fire-sale exits, or shutdowns

Political risk is now a material driver of valuation, diligence, and exit outcomes

32% of venture-backed companies

face regulatory or political crises that materially impact valuation

89% of Series C+ investors

now require formal political-risk assessment during due diligence

Unmanaged political risk leads to capital erosion,

including 30–50% valuation discounts and $2M–$50M crisis response costs

Failure to anticipate risk delays or destroys exits,

causing 12–24 month fundraising delays, fire-sale exits, or shutdowns

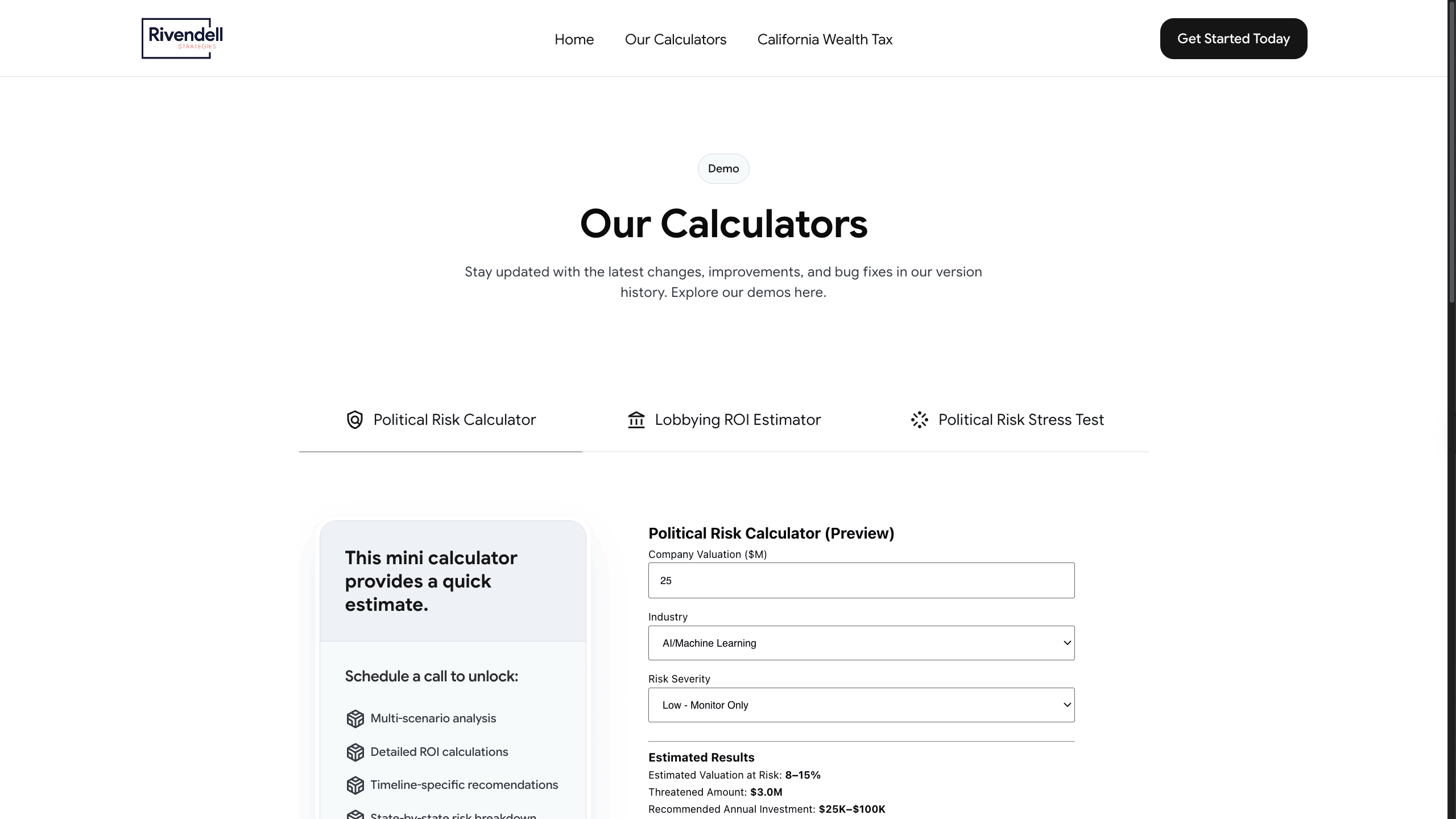

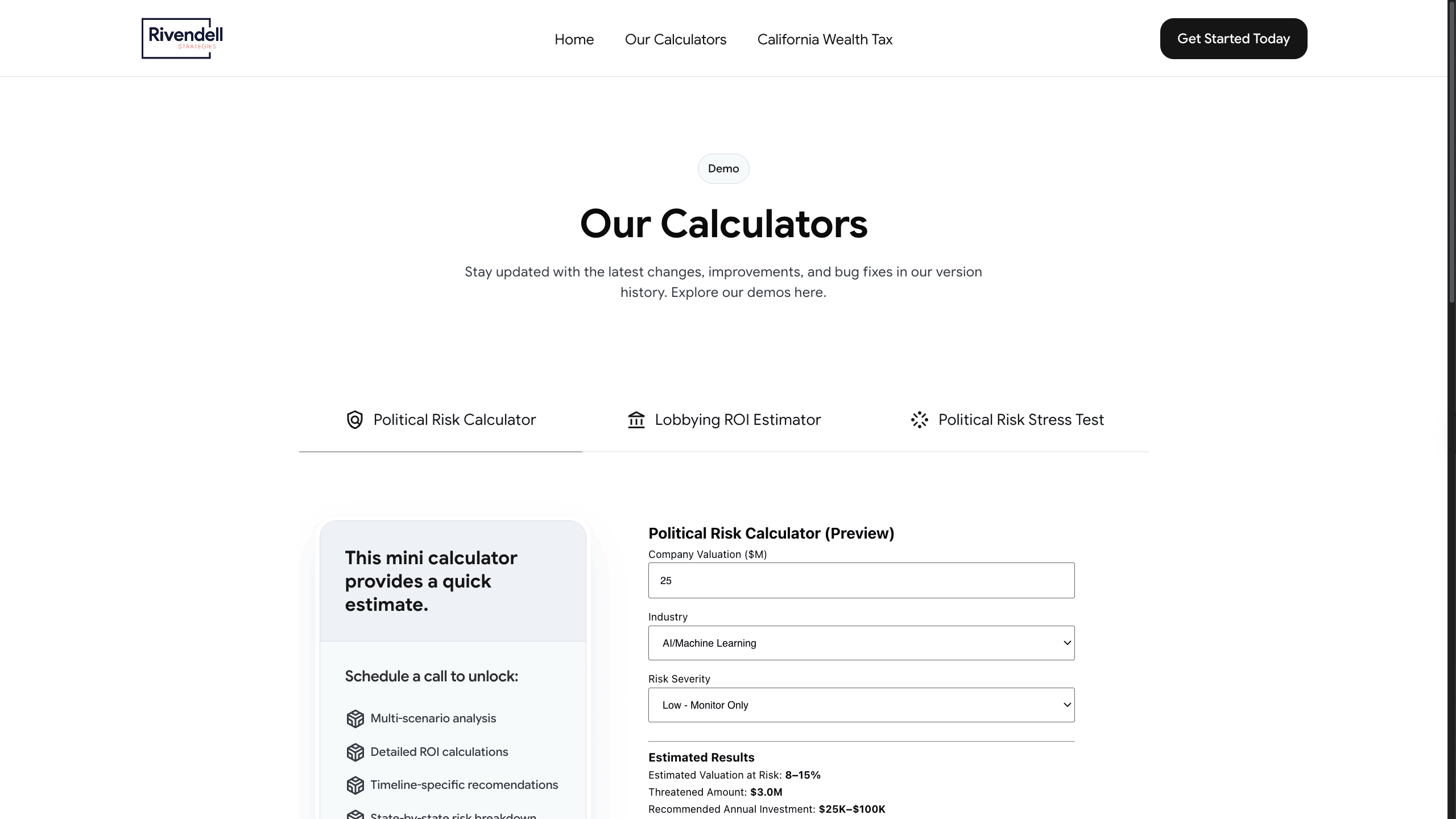

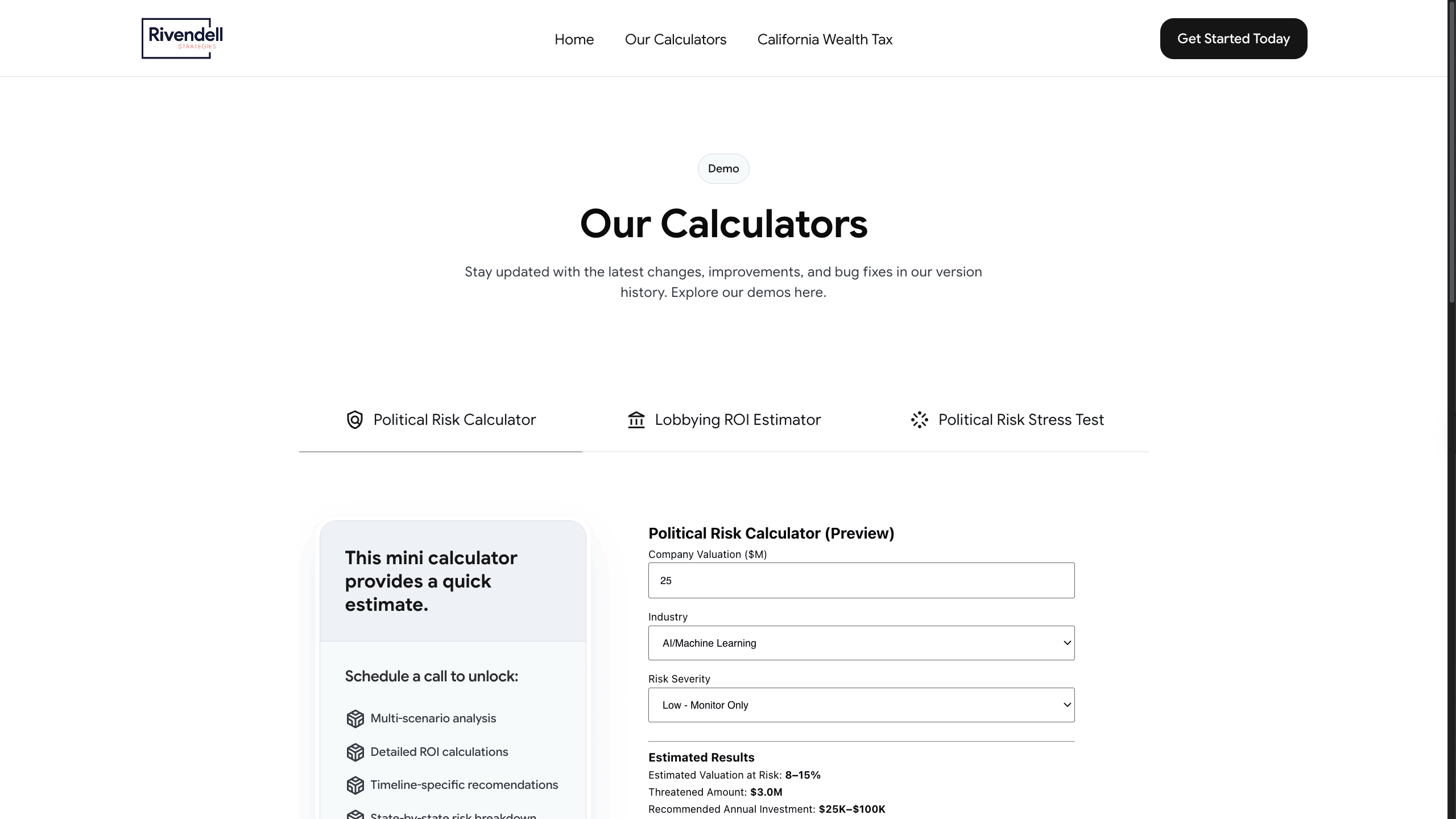

Our Calculators

What Rivendell Offers

Explore the tools and capabilities that will quantify your political risk.

Our Calculators

What Rivendell Offers

Explore the tools and capabilities that will quantify your political risk.

Our Calculators

What Rivendell Offers

Explore the tools and capabilities that will quantify your political risk.

Lobbying ROI Estimator

Lobbying ROI Estimator

Lobbying ROI Estimator

Political Risk Stress Test

Political Risk Stress Test

Political Risk Stress Test

Political Risk

Political Risk

Political Risk

Traditional

Lobby Shops

See how Rivendell differs from traditional lobby shops.

OTHER PLATFORMS

Focused on Large Corporations

Focused on Large Corporations

Focused on Large Corporations

Personalized Risk Management

Personalized Risk Management

Personalized Risk Management